How to Apply for Alfalah Bank Loan

The Bank Alfalah Pakistan 2023 is offering different facilities for giving the Loan and tell him the complete details of How to Apply Loan from Alfalah Bank Pakistan in which the whole term and conditions are brief in this article you can online read and check the full Alfalah Finance Green Home Mortgages for Solar system, Alfalah Personal Loan, Alfalah Auto Loan for car and the final last is Alfalah Finance Loan for Home these plans are introducing the Bank Alfalah for the community of our country. Just click resources for more information.

Loan Procedures

The age limit is between 23 years to 65 years when you submitted the application and your income is at least Rs. 300,000/= regular monthly basis and the professional business experience is at least 05 years then you are eligible for Loan. Visit this link https://citrusnorth.com/installment-loans/ for more details.

There are many types of loans but the process is still basically the same, from a loan for an apartment, a house, a residential home construction, any kind of building construction, and even hotel financing, but for all, you will have the pre-qualification that is when the loan process starts, once a lender has gathered information about a borrowers income and debts a determination can be made as to how much the borrower can pay for a house. Since different loan programs can cause different valuations a borrower should be pre-qualified for each loan type the borrower may qualify for,

Then you choose the mortgage programs and rates to analyze the best plan to keep the loan, once you have this you start with the processing, get the required documents, your credit reports, and the application. There are also the appraisal basics, in which real estate is the valuation of the rights of ownership. The appraiser must define the rights to be appraised. The appraiser does not create value, the appraiser interprets the market to arrive at a value estimate.

Once the processor has put together a complete package with all verification and documentation, the file is sent to the lender. The underwriter is responsible for determining whether the package is deemed an acceptable loan. If more information is needed, the loan is put into suspense and the borrower is contacted to supply more information and or documentation. If the loan is acceptable as submitted, the loan is put into an approved status, and the closing is when the loan is approved.

Documentations:

- Application documents complete.

- Original NIC copy.

- 02 new photographs.

- The fee for cheque processing.

- Account Bank Statements.

- Property of your documents photocopies.

- Personal Salary slip for last 03 months attested by an officer.

- Employment certificate.

- 06 months bank account statement.

- Employment verification form in BAL format.

- Cash vouchers (In case of cash salary).

Eligibility Criteria

- Original Pakistani National Identity Card

- Aged 21 to 60 years between

- Self Employee of any Punjab Govt.

- Salaried from Semi-Government or Punjab Government

- Professions any private and govt. businessman

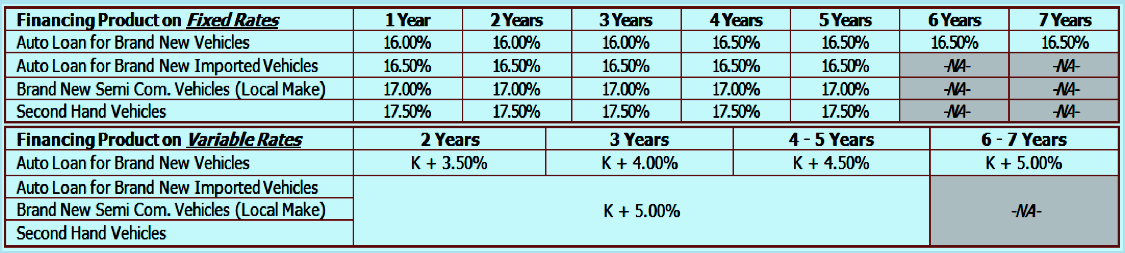

- Markup Rates per year

Financing Products on Fixed Markup Rates & Table

- 01 Year = 16.00 %

- 02 Years= 16.00 %

- 03 Years = 16.00 %

- 04 Years= 16.50 %

- 05 Years= 16.50 %

- 06 Years= 16.50 %

- 07 Years= 16.50 %

These Alfalah Bank Loan terms and conditions are applied to every person who has the loan for a home, car, and for other personal works. The whole details of Bank Alfalah Loan procedures here can check online and free download the application form loan alfalah bank Pakistan. This bank is the key to your dream home to success through Alfalah Home Loan, alfalah car loan procedure, how to apply for an alfalah bank personal loan, and for more details check the official website at bankfalfalah.com.